Job Market In Jeopardy Without Fiscal Support From Congress

The job market recovery from the coronavirus recession is faltering as the U.S. braces for a steep decline in fiscal support from Congress despite the burgeoning pandemic.

As the rapid spread of the novel coronavirus smothers economic activity across the U.S., two months of stellar job gains have begun to slip and lawmakers remain far apart on a new round of federal aid.

The Friday lapses of a $600 weekly boost to jobless benefits and a national eviction ban bode poorly for the growing number of Americans seeking unemployment aid.

New weekly applications for unemployment insurance increased last week for the first time since March, according to the Labor Department, and the number of employed Americans declined by 4.1 million between the first and second weeks of this month, according to weekly Census Bureau data released Thursday.

Those dire signs of deepening economic damage could spell trouble for the July jobs report, which some economists fear will show the first net decline in U.S. employment since April.

With lawmakers far apart on sorely needed aid, economists worry that partisan squabbling and the steady pace of COVID-19 infections could wipe out the ground gained since the onset of the crisis.

“Because of the inability of the political sector to put in place another round of aid in a timely manner, investors should anticipate a significant slowing in household spending and another round of permanent job losses,” wrote Joe Brusuelas, chief economist at audit and tax firm RSM, in a Wednesday research note.

“Although we think the worst of the economic shock is in the rear-view mirror, this economy is not yet out of recession and could very well remain in negative terrain if there is not sufficient policy support.”

The onset of the coronavirus pandemic spurred the quickest and deepest economic collapse in modern U.S. history. More than 20 million Americans lost their jobs between March and April, pushing the unemployment rate to a post-Great Depression high of 14.7 percent.

Congress responded by spending roughly $3 trillion on pandemic-related stimulus and support for various sectors, with hundreds of millions aimed at shoring up small businesses that employ millions of Americans across the country.

While the U.S. has now recovered 8 million of the jobs lost to the immediate shock of the pandemic, a resurgence of coronavirus cases is threatening that progress.

The U.S. passed 4 million confirmed cases of the novel coronavirus on Thursday, more than any other nation even when accounting for increased testing capacity. California and Florida both reported record numbers of daily coronavirus deaths soon after.

White House coronavirus task force coordinator Deborah Birx said Friday that the health crises in those two states and Texas mean the country faces epicenters in multiple areas, compared to earlier in the pandemic when New York accounted for a large number of the country’s cases.

“What we have right now are essentially three New Yorks with these three major states,” Birx told NBC.

“We’re really having to respond as an American people, and that’s why you hear us calling for masks and increased social distancing to really stop the spread of this epidemic,” she added.

Governors in hard-hit states have gradually reemployed orders to close restaurants, bars and gyms that likely spurred the rebound in coronavirus cases. But economists have warned for months that rising virus infections hamper the economy even when state and local governments don’t impose new business closures.

A range of real-time private sector data released this week make the case.

The number of shifts worked by U.S. frontline workers increased by just 0.7 percent each week on average in July after rising by 1.9 percent in June and 2.7 percent in May, according to Kronos, which provides timekeeping and payroll software for businesses. The data, which Kronos says is drawn from 3.2 million employees across 30,000 businesses, appears to show business activity plateauing after two months of steady gains.

Job postings from businesses have also declined through July, according to Homebase, a workforce management software company that tracks 60,000 businesses with 1 million employees for labor force changes.

The number of new jobs posted by businesses was down roughly 16.6 percent in June from the first two weeks of March, according to the company’s data. From July 1 to July 9, job postings were down an average of 22.7 percent from the first two weeks of March.

“Areas that have seen a spike in coronavirus cases are seeing declines in business activities, although the declines are not as steep as during the first wave of cases. Hiring for hourly workers, however, is now below the levels we saw before the coronavirus pandemic,” wrote Ray Sandza, vice president of data and analytics at Homebase.

As the economic recovery from the first wave of coronavirus cases slows, pressure is building on lawmakers to deliver relief as millions of vulnerable Americans approach the edge of a fiscal cliff.

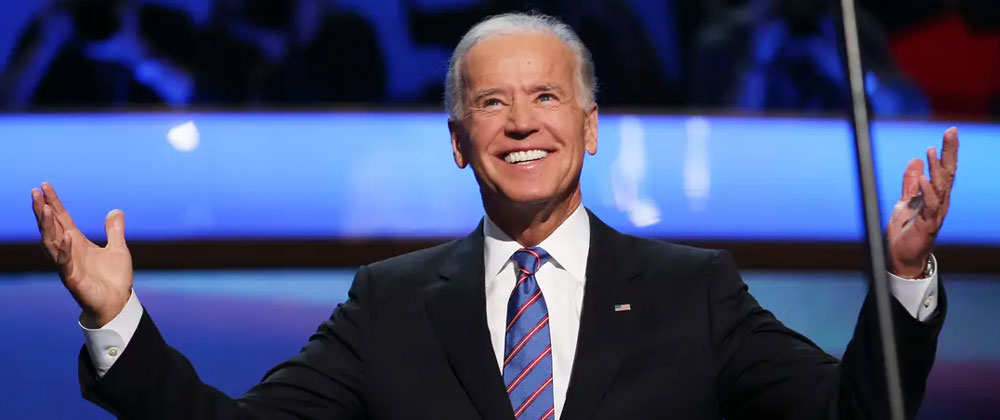

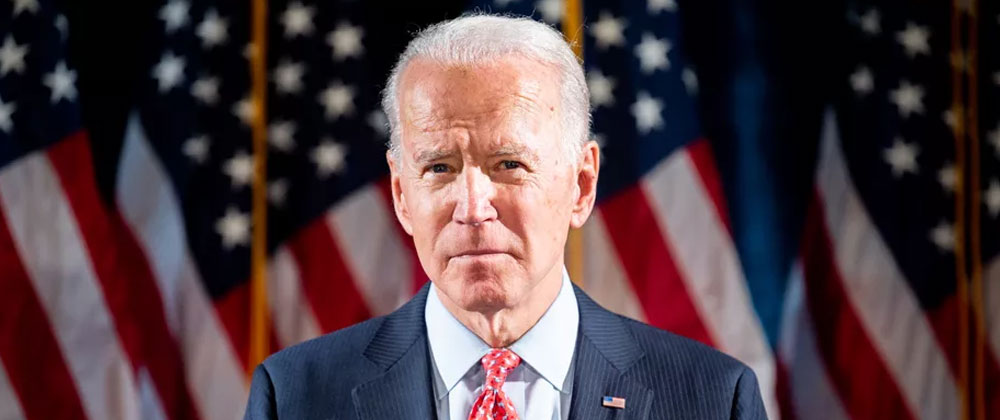

The White House and Senate Republicans are aiming for a package of roughly $1 trillion to balance the need for further fiscal support with the objections of GOP debt hawks opposed to piling onto the roughly $3 trillion already spent on the pandemic.

Democrats, meanwhile, are countering with a more than $3 trillion bill passed by the House in May that Republicans have dubbed a liberal wish-list.

There are roughly 30 million Americans receiving some form of unemployment insurance whose earnings will plunge without the $600 weekly boost that sustained them. Millions of Americans who do not live in housing backstopped by the federal government can also face eviction proceedings over the next few weeks with less money to fund a move.

Along with unemployment benefits and housing issues, lawmakers will also need to strike a deal on further aid for small businesses. Republicans are set to propose a third round of Paycheck Protection Program (PPP) loans, likely tapping the roughly $130 billion leftover from the $659 billion total authorized by Congress.

“Mismanagement of the public health crisis has led to a renewed slowdown in activity as households and businesses voluntarily limit their activity and governments are forced to re-impose restrictions. To make matters worse, Congress is still debating the next round of fiscal aid,” Nancy VandenHouten and Gregory Daco from Oxford Economics wrote in a research note.

“We believe a decline in payrolls in July is a now distinct possibility with claims rising, hours worked plateauing and the Household Pulse survey pointing to a net job loss.”